ECA INSIGHT >>

Will gas-fired power generation be forthcoming after the rapid closure of lignite plants in Greece?

Aug, 2020

To help achieve climate change targets, Greece will be closing its lignite power plants by 2023. This plan relies on the expected development of gas-fired generation to partly substitute for the closures. In this Insight, we consider how the closure of the lignite plants and the related development of renewable energy may affect the attractiveness of gas-fired power generation for investors.

The planned lignite plant closures

The National Energy and Climate Plan (NECP) for Greece sets out the country’s energy sector outlook for the period 2020-2030. The plan is largely driven by the objective to reduce greenhouse gas emissions in 2030 by more than 56% compared to 2005. Key elements of the Plan are the increased penetration of renewable energy (RE), the improvement of energy efficiency across all sectors, and the closure of all lignite-fired power units by 2023[1].

Lignite-fired power plants which historically served base load have diminished in importance in Greece’s power generation mix, largely driven by the implementation of Directive 2010/75 EC on industrial emissions and the application of the EU Emissions Trading System (EU ETS). In 2019, for example, the capacity factor of the 11 units still in operation only ranged between 5% and 31%.

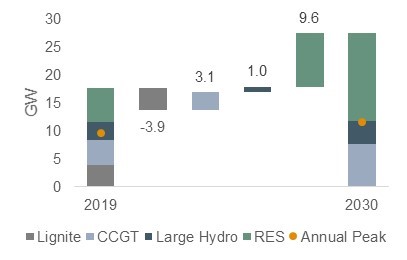

The planned closures have provoked controversy because of their impacts on employment and local economies[2] but here we consider another issue – that the rapid plant closures require the replacement of almost 34% of current dispatchable installed capacity, mainly by natural gas-fired plants[3], alongside a more than doubling of the non-firm RE-based capacity (see Figure 1).

Figure 1 Planned generation capacity additions and withdrawals, by type

Source: ECA, based on the approved Generation Adequacy Study for the period 2020-2030, ADMIE, Dec 2019.

Demand growth of approximately 19% over the period 2019-2030 is expected to practically exhaust the capacity reserve of dispatchable units, from about 19% of peak demand in 2019 to less than 2% in 2030. This raises concerns over security of supply, as well as the economics of the sector.

Has everything been accounted for?

The Generation Adequacy Study for the period 2020-2030 carried out by the system operator, ADMIE, provides an analysis of the potential impact of the changed generation mix on the security of electricity supply, subject to: NECP provisions regarding demand growth; planned generation development; alternative scenarios for demand growth and hydro output; and potential delays in realising investments in new firm capacity. The Study concludes that subject to those assumptions and plans, the Loss of Load Expectation (LOLE) and Expected Unserved Energy (EUE) indicators, as measures of system adequacy, remain within acceptable levels during the period.

However, the Study also noted that the period 2021-2024 is critical for system adequacy, because during that time lignite-fired plants will be decommissioned and would not have yet been replaced by new firm capacity, thus reducing reserves. According to ADMIE, demand growth exceeding the forecast (eg due to lower than projected energy saving measures), unfavourable climatic and hydrological conditions and delayed commissioning of planned new capacity may jeopardise the system’s ability to sufficiently cover load during that period.

Among these three critical factors enumerated by ADMIE, timely investment in new generation capacity will largely be reliant on private sector investment. This will be driven by electricity market conditions, which in turn will be materially affected by the penetration of non-firm RE.

Are the underlying economics for private-led CCGT investment favourable?

The Generation Adequacy Study does not include an analysis of whether the market will be favourable to new investment.

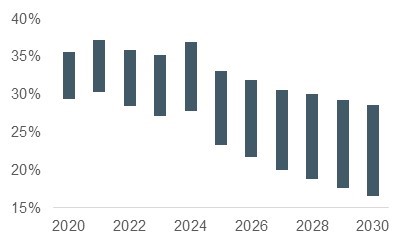

The sharp rise of RE-installed capacity, in combination with a modest average increase of annual peak demand by 1.6% suggests that CCGT capacity factors will drop. Assuming capacity factors based on historical performance over the previous decade apply for RE generation and large hydro power plants (ranging between 20%-25% and 13%-25%, respectively, over 2009-2018), thermal power plant capacity factors would be expected to gradually decline, especially from 2024 onwards. As shown in Figure 2, the capacity factor may drop to as low as 16.5%.

Figure 2 Range of thermal plant capacity factors

Source: ECA

Investment in CCGT plants would not typically be attractive at these capacity factors if revenue is based on electricity generated alone. The Capacity Adequacy Remuneration Mechanism may provide another source of revenue but the methodology for this is yet to be developed, and will affect the profile of prices in the wholesale markets to be deployed in the new electricity market based on the EU Target Model (scheduled to go live on 17 September 2020), adding to investor uncertainty.

Superimposed on the above is the expected fall in wholesale electricity prices if RE generation is to double as a share of gross electricity consumption by 2030, as set by NECP. Most RE-based generation has zero or negligible variable cost, therefore to the extent that market prices will reflect the short run marginal cost of energy, depressed wholesale energy prices would further discourage investment in CCGT plants (absent other revenue sources).

It appears then that achieving the ambitious NECP targets that combine increased penetration of RE generation, alongside the replacement of lignite-fired with new gas-fired generation requires careful design of the capacity mechanism to ensure that the needed investment in CCGT and RE generation is forthcoming and that security of supply conditions in Greece’s electricity market are maintained.

[1] Except for a 660 MW unit scheduled for commissioning in 2020, which will operate on lignite until 2028 and then convert to another fuel.

[2] It is estimated that lignite-fired power generation accounts for 1/3 of regional GDP in the affected areas and that about 27,000 jobs are at risk due to the closure of lignite-fired plants (see EU Commission SWD (2020) 507 final/2, 27 Feb 2020).

[3] Primarily combined-cycle gas turbines (CCGT).