ECA INSIGHT >>

With progress towards net zero, many believe that we are in a post market world for electricity delivery. With the marginal plant regularly being one with zero variable cost (wind, solar, etc.) setting the market price at zero, the pricing signals cease to instruct.

Various alternative models are being touted. This piece looks at some fundamentals of what is required from the electricity system and how long-term and short-term efficiency in investment and dispatch can be encouraged in the new world. To do this, we break down electricity delivery into its component parts and look how the derivation of price signals has changed.

The models on offer seek to create parallel markets with only one of those markets retaining price signals. This will not solve the core problem, which is lack of price signals for efficient dispatch and investment – significant generation operating outside the price signals will still remain a distortion

Why does net zero threaten markets?

Markets set short or long term prices based on the cross-over price where the price of the marginal seller equals that of the marginal buyer. In electricity this will be the price of the marginal generator in the merit order stack. This is the efficient price signalling scarcity and can be used to inform when a more expensive generator should be dispatched or a new generator should be built.

The development of renewables such as wind and solar with zero variable costs will distort these price signals – especially if there are incentives from the support scheme to generate even below cost (negative prices). In reality it is not the zero price signal that is the problem – it is a valid market price signal – it is rather that the support scheme is bringing on new generation that could not be built without the support so it is not a level playing field.

Investment economics

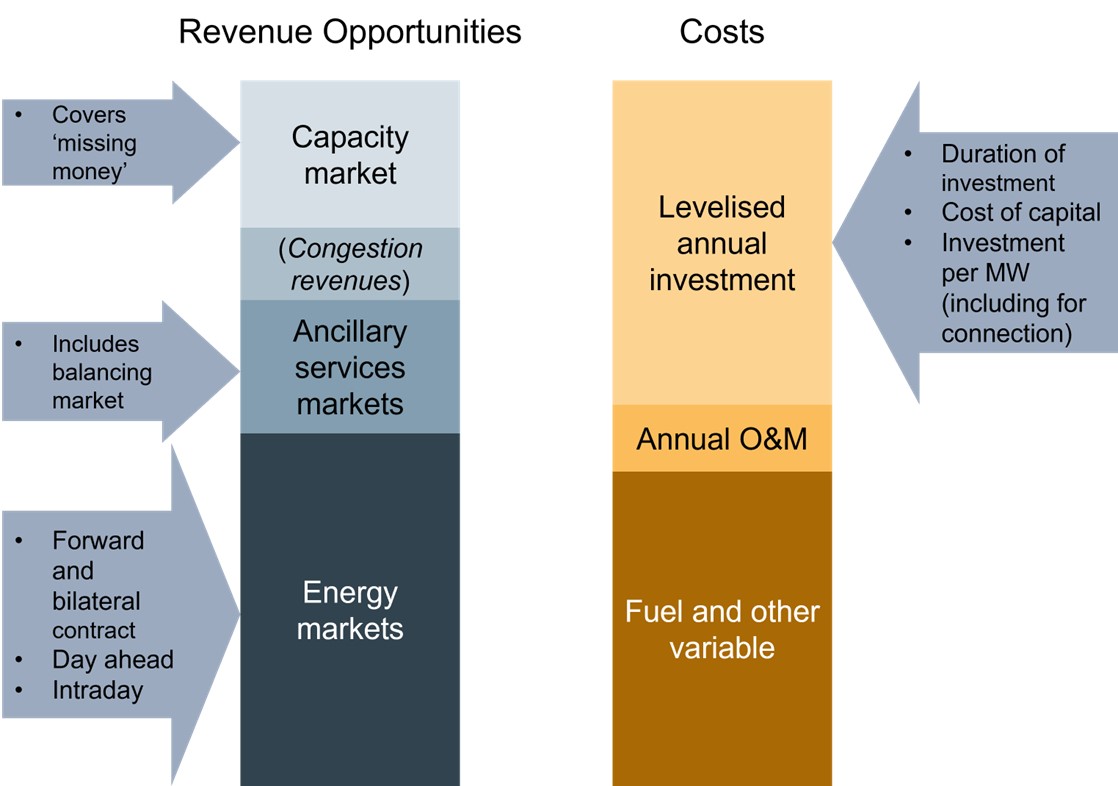

When deciding to invest in a new generating plant, storage device or even demand side curtailment capability (often called DSM), the investor will look at multiple potential revenue streams. Figure 1 shows the potential revenue streams and also the component costs that must be covered.

Figure 1 New build revenue streams and cost

The significant change brought about by new technologies is often in the cost components side. A wind farm, for example, has fairly high fixed costs but negligible variable costs. Some investors have a dedicated revenue stream from a support scheme. Depending on the design of the scheme, it can replace some or all other revenue streams.

Markets have changed but not been removed

In an energy market where spot prices are set by merit order, conventional generators with significant variable costs are seeing their run times fall (capacity factors that should be 80%-90% are now habitually below 50% in GB and other markets); they cannot rely on earning margins above variable cost (inframarginal rents) to pay off their fixed costs when they are not running much. Investors without a support scheme must rely on other revenue streams to be profitable. Looking at the revenue streams in Figure 1, auctions have replaced energy-only markets as follows:

- Capacity. Capacity Reliability Mechanisms tend to have two components: long run contracts for new build are offered in auctions, usually four years ahead of required commissioning, and annual auctions for existing capacity. Targeting peak availability, these auctions have tended to attract peaking plants such as diesel, not necessarily suited to delivery when energy is needed at other times; rules have needed to be tightened to disallow plants with high carbon emissions. Capacity markets have become more prevalent to address the missing money problem [1] left by too many zero-price settlement periods in short term energy markets [2].

- Ancillary services. Although markets are moving towards day ahead auctions and co-optimisation routines to mesh these procurements for frequency control reserves with day ahead energy markets, many ancillary services are being procured in auctions for participants to commit to availability to deliver when needed. This may be needed where investment in capability to deliver is required. The short-term auction model is in line with pre-existing balancing market procurement auctions for real-time delivery of flexibility.

- Renewables. Feed-in tariff regimes have moved on and are increasing using capacity market type payments guaranteeing a price for all metered energy delivered but with the energy component being delivered into the energy markets; a Contract-for-Difference (CfD) pays or charges the renewable investor for any discrepancies between the market price and the guaranteed price.

This leaves congestion revenues – always a difficult area, and often managed through bilateral contracts or balancing markets – and energy markets, which tend to rely on day ahead cross-over auctions to set a price and on forward and bilateral contracts.

Who relies on which markets?

Conventional generators. These are the generators for whom the energy markets were designed. Coal and gas-fired generators convert fossil fuels into electricity and expect energy markets to pay sufficient to cover their variable costs at least, with the ones with costs below the system marginal price (SMP) earning inframarginal rents to cover fixed costs. From the start, certain conventional generators did not fully meet this pattern:

- Nuclear generators have very low variable costs. In France, the marginal plant has often been nuclear but a reliance on cross-border trading and greater flexing of nuclear output has been instrumental, to date, in ensuring zero-priced trading periods have not been too prevalent.

- Hydro-electric generators with significant reservoirs. These generators may price on opportunity cost in day ahead markets, seeking to dispatch when prices are forecast to be highest.

All conventional generators will seek revenues from capacity markets and ancillary services markets as well.

Renewable generators. Depending on the support scheme, these generators will tend to be indifferent to day ahead market prices and will usually not be able to participate in ancillary services markets because they cannot control dispatch. In some market designs, they may be eligible for capacity market payments but this will depend on how penal the rules are if they cannot be available at peak.

Storage. These generators will seek revenues in all markets but will mainly rely on ancillary service markets where their degree of rapid response flexibility can command a premium, and on energy arbitrage where they seek to buy energy during forecast low price periods and sell it at peaks.

DSM. Demand side will tend to sell load reduction as an ancillary service activated in balancing markets. Usually, a high reserve price will be applied. They may also participate in capacity markets.Sub head 5

All markets still need a reference price – the energy market is still the bedrock of pricing

All revenue streams tend to rely on the energy markets to set the reference price – the price to be avoided:

- Renewables use CfDs with the day ahead energy market setting the reference price from which the CfD payments result. The capacity markets seek to pay for missing money not provided by energy markets.

- Forward energy markets price at the avoided cost from the day ahead market.

- Ancillary services markets tend to co-optimise against day ahead market revenues selling their capacity as an option for the TSO when this is more profitable; this applies to the balancing market as well.

- The capacity market is paying the missing money not provided by the other markets.

- Even the day ahead market will price at the predicted avoided cost of imbalance settlement.

All this relies on the energy market – usually day ahead – setting a reference price based on merit order.

What if there is no merit order?

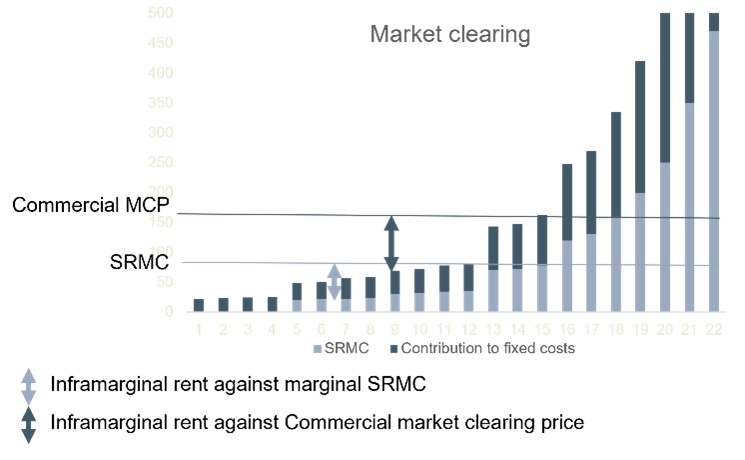

Figure 2 shows a stylised merit order for a settlement period. Cheaper generators rely on inframarginal rents to contribute to fixed costs. This is made easier where prices in the balancing market affect commercial offers in the day ahead market because the market clears[3] at a higher price than short run marginal cost (SRMC).

However, if the marginal generator is one with zero SRMC and if those zero-cost generators are even willing to accept negative prices to ensure they are dispatched (because their CfD pays out on metered energy) then the business model of many players will be upended.

Figure 2 Merit order and market revenues

Also relevant is that peaking prices might frequently disappear for days on end, for example, during periods when there is significant wind. This removes pricing opportunities for storage and hydro.

Solutions being touted

One idea is to separate out markets for different generator types. This is being considered under the REMA exercise in GB. There would be two types of energy provider:

- Capacity only. This would suit renewables, nuclear and, according to some, hydro-electric. They would be paid based on installed capacity and dispatched only when operational conditions allow. They would be indifferent to dispatch because they earn no money from it.

- Energy and capacity. This would suit conventional generators and they would operate on merit order principles setting marginal prices based on SRMC or commercial principles. They would be protected from zero-prices due to curtailment of capacity-only outputs. They could supplement income from an additional capacity market but this is not a prerequisite.

Added to these would be ancillary services. These would be co-optimised against a constrained schedule consisting of allowed capacity-only forecast output and the scheduled energy-and-capacity outputs. Storage operations and DSM would be included in this schedule.

A grey area would be the requirement for investment in ancillary service capability for sufficient flexibility. There might need to be another form of capacity market that pays out incentives sufficient to invest in capability to be available to deliver flexible energy. This is different to the capacity mechanism that pays out for availability at peak and not at other times – specialist equipment is needed to quickly deliver the flexibility needed in a system where much of the load is being served (or not) by variable renewable generation.

It should be noted that maintaining balancing is expensive if large amounts of intermittent generation must be reserved against. In the recent REMA consultation it was noted that “Recently, there have been significant increases in balancing costs. Last winter costs in the Balancing Mechanism rose to over £1.5bn from an average of £0.5bn over the previous four winters”.

But what about price signals?

This model is inevitably, to a large extent, a command-and-control environment. What it is really doing is artificially curtailing the output of the ‘capacity-only’ contracts to ensure there is space for other producers to sell at a price above zero. But this is abandoning the least cost price signals that pure merit order is meant to provide.

The first problem is therefore that this is not least cost. Curtailing zero-variable-cost generation is, by definition, increasing short-run costs.

Another aspect to consider is that the problems being encountered in the current environment are caused by variable renewable energy (VRE) at high penetration that does not perform as forecast. This necessitates a high level of contingency reserve that can be dispatched down, if the VRE appears or is prevalent at the day ahead stage, or dispatched up, if the expected VRE does not materialise. This does not fundamentally change in this new model.

The other problems with the model are:

- Rules for which ’capacity-only’ generators curtail to ensure fairness.

- Ensuring meeting net zero targets if ‘capacity-only’ generators are being curtailed to ensure that other generators set a non-zero market price.

- Incentives to efficient investment in those ‘capacity-only’ resources; if output is irrelevant to them, how can least cost per MWh per generator be ensured?

- Again, incentives on ‘capacity-only’ generators to actually maintain and operate their equipment if they are being paid regardless of whether they generate or not.

- Trade-off between peaking prices and off-peak prices in the ‘energy-and-capacity’ sector. In order to incentivise investment in the ‘energy-and-capacity’ sector, sufficient demand must be allowed for these generators such that spike prices emerge. This is not set by a market mechanism.

- Role of ‘capacity-only’ generators in provision of ancillary services. Given that current capacity mechanisms are designed to provide availability to provide security of supply, should these generators be paid for this provision even though their ability to do so is often limited?

- Treatment of interconnectors. This is a current unresolved issue in terms of security of supply. Interconnector flows play a major role in evening out prices in Europe through market coupling. This has the intentional effect of smoothing out price spikes and troughs through inter-market arbitrage. But if price spikes are needed to incentivise investment, then interconnector flows may simply have the effect of further reducing the output of the ‘capacity-only’ generators.

Markets provide efficiency by signalling scarcity

Reaction to marginal price signals leads to efficient welfare-maximising behaviour including in investment decisions. However, in a world where there are distortions such as guaranteed prices for certain types of investment then ways to correct for the distortion must be found. Alternatively, markets can be abandoned and a planned environment can be introduced. What has been proposed to date is some form of halfway house; this is seeking the best of both worlds but will it deliver the opposite?

Clearly, there is much more thinking to be done.

[1] ‘Missing money’ refers to a situation where short term markets are setting prices very close to short run marginal cost and too few producers are able to recover fixed costs at these prices. The situation can sometimes be remedied in markets where producers are able to bid above short run marginal cost.

[2] A tendency for the authorities to take fright when markets signal scarcity with very high prices has also been a contributor to the missing money problem.

[3] Market Clearing Price (MCP) is set in day ahead cross-over auction markets where supply matches demand.

Rob Barnett

Technical Director

Rob has worked on design of electricity, gas and renewables markets and has advised on processes and costs in the UK and a number of other countries. He has worked for governments, regulators, system operators and private clients in all these areas.

To contact Rob directly please email or connect with him on Linkedin below.