ECA INSIGHT >>

Over half of the global population currently lacks access to a safe, affordable, and reliable water supply. An estimated 676 million people depend on alternative off-utility supplies, as piped connections are often not economically feasible in the short run. Off-utility water service providers (OUWASPs) can bridge this gap as an interim solution to expand access.

A recent World Bank publication developed in collaboration with ECA provides insights on how safely managed OUWASPs can contribute to attaining the ambitious SDG 6.1 universal coverage target.

A bridge solution to complement utility models

Governments have committed to meeting SDG 6.1 to achieve universal and equitable access to safe and affordable drinking water by 2030. In addition, the COVID-19 pandemic has highlighted the importance of access to a universal and equitable water supply while developing long-term resilience.

In low-income countries, piped water networks only reach a small proportion of the population. By 2030 an estimated 1 billion people will lack access to piped services. Extending piped water supply, however, comes with several challenges:

- Extending piped networks to sparsely populated rural areas is not economically viable for water utilities.

- While average costs of piped connections are significantly lower in densely populated areas due to economies of scale, urban settlements’ congestion and unplanned nature often complicate their installation.

Thus, while the long-term objective remains to extend safe and affordable piped services to all where scale and population density allow it – piped connections incur lower recurrent costs due to economies of scale while providing a higher quality service – geographic and infrastructure financing constraints, and limited local water resources prevent this from being universally adopted in the short term.

As high capital costs and institutional bottlenecks have limited the rapid expansion of access to piped water, various OUWASP business models have evolved to meet water supply objectives and complement traditional centralised water utilities. OUWASPs, therefore, play an essential role as a bridge solution to deliver water services and achieve SDG 6.1 where access to centralised networks is limited or piped services are not feasible due to density or technical constraints.

OUWASP businesses can take various forms

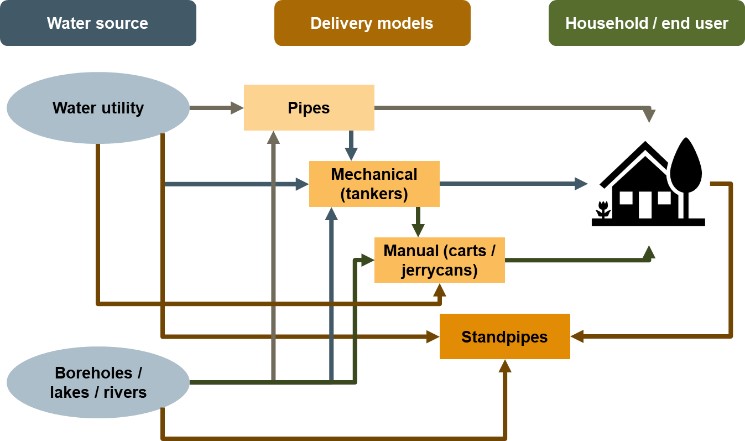

There is a wide range of OUWASP delivery models. These range from standpipes and kiosks, where households collect water from a fixed location to household delivery through jerrycans and bottles, trucks filling on-site storage, and piped water mini-grids.

Figure 1 OUWASP delivery modles

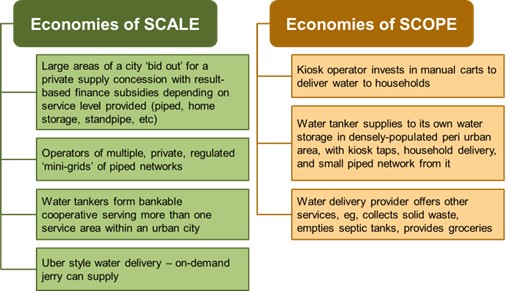

As these business models grow, they can deliver economies of scale and scope; unit costs can fall by spreading fixed costs over a larger customer base, and OUWASPs can increase product offerings to the same customer base.

Figures 2 OUWASP scale and scope economies

Where geography allows for the development of small, piped networks, OUWASPs can operate independently from the incumbent utility and supply water directly to households, delivery agents, or standpipes. This is the case in Cochabamba, Bolivia, where private water mini-grids receive water from three sources – the municipal system, their own source, or water delivered by tanker trucks.

Similarly, in Paraguay, OUWASPs known as aguateros have progressively invested in water supply systems, from water carters, to trucks, finally building small, piped networks in areas not accessible to the public utility. Aguateros launch their operations in areas not already served by the utility or other providers and expand their supply network until it reaches a neighbourhood served by the utility or a different aguatero. While their exclusive right to operate in unclaimed areas is typically respected, aguateros lack a robust legal standing within the water sector regulatory framework and are often not recognised by national water policies

Creating a conducive operating environment

The example of Paraguay highlights the delicate relationship between traditional utilities and OUWASPs in expanding coverage and access to a water supply.

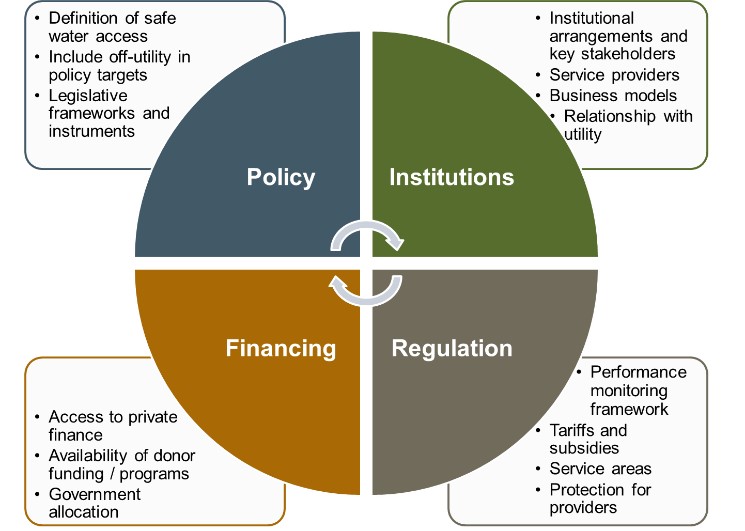

A prerequisite to scaling up OUWASPs is the formalisation of the OUWASP sector in national water policy frameworks, with established targets and the commitment by policymakers to champion the provision of OUWASPs as a component of nationwide water service delivery. This, in turn, requires the clarification of institutional arrangements and responsibilities attributed to different entities. Most important is the relationship with the incumbent utility, to incentivise institutional collaboration.

The Paraguay example also emphasises the necessity of licensing and regulation of the OUWASP sector to ensure temporal exclusivity over geographic areas and protect OUWASPs against usurpation by the utility. This can be achieved by introducing appropriate ‘light-handed’ regulations governing the OUWASP sector through licenses or contracts and requiring minimum service standards to guarantee water and service quality.

Finally, enabling policy, institutional, and regulatory frameworks inevitably depend on the availability of sustainable finance to fund the upfront investment costs (and potentially some ongoing costs). Such finance may initially be sourced from government budget allocations and grants from development partners. These sources of finance can lower costs to serve customers and gradually decrease tariffs, reducing volatility and increasing investment viability in OUWASPs.

Figure 3 PIRF framework

Ester Vespasiani

Senior Consultant

Ester joined ECA in October 2017 after finishing her Master’s degree in Economics at the London School of Economics and Political Science in July 2017. She holds a BSc in Economics and Business Economics from Maastricht University (NL), with specialization in International Economic Studies. Since she joined ECA, Ester has been involved in various assignments across different sectors.