ECA INSIGHT >>

The business case for Battery Energy Storage Systems (BESS)[1] in Europe is determined by revenue stacking, ie the ability of operators to obtain revenues from different sources and markets. While long term capacity remuneration helps provide investor certainty, it is revenues from frequency response ancillary services (AS) that have proven to be critical drivers of BESS investments. Of particular importance to the value proposition is the capability of BESS to deliver extra fast response times (sub 2 seconds). This Insight looks at such fast response AS in more detail and concludes that they constituted up to 40% of revenues for BESS operators over recent years. This makes the treatment and remuneration of these services an essential component to consider for system operators, regulators and policymakers when designing BESS investment frameworks.

Battery revenue stacks

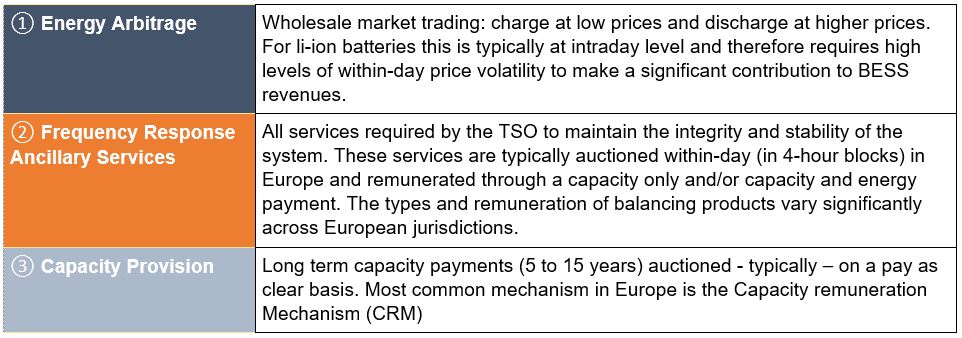

The three most important revenue sources for BESS in Europe are (i) wholesale energy market arbitrage, (ii) ancillary services and (iii) long term capacity provision. Figure 1 summarises the key features for each. We focus in this insight on grid-scale BESS operating commercially and not network investment deferral assets (eg ‘grid boosters’ in Germany or ‘virtual power lines’ in France), which cannot actively participate in power markets as per EU legislation.

Figure 1 Battery revenue sources

Each revenue source provides different levels of certainty and return for BESS. Capacity payments are considered the most stable revenue source for investors, but their levels and attractiveness will depend on capacity market design elements such as derating factors, type of auction (pay-as-bid or pay-as-cleared) and duration of payment. An ECA review of recent capacity auctions in selected European jurisdictions shows that this revenue stream makes up between 10% and 30% of revenues for batteries.

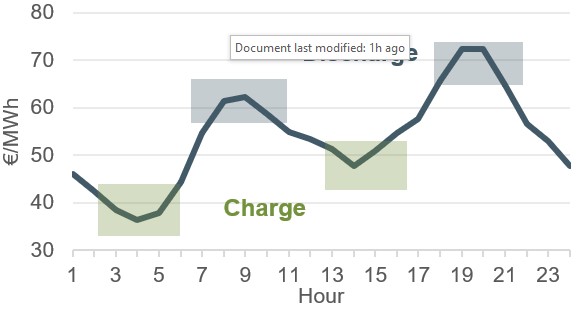

Wholesale market arbitrage revenues require high levels of volatility as illustrated schematically in the figure below. Despite recent increased volatility in European electricity markets, the average within-day price variations over recent has been low in Europe. We estimate that the arbitrage opportunities made up between 10% to 20% of battery revenues over the last few years (excluding 2021). With greater variable renewable energy (VRE) penetration, higher gas and CO2 prices, the volatility may rise in future making this revenue stream increasingly attractive. However, it remains an uncertain revenue stream.

Figure 2 Wholesale market arbitrage illustration

With long term capacity payments and arbitrage making up at most 60% of revenues, it is worth considering frequency AS and the role BESS play in these in some more detail.

Frequency Response AS: a brief overview

Confusingly, the terminology (and acronyms) used for frequency response AS is not consistently applied in Europe, let alone globally[2].

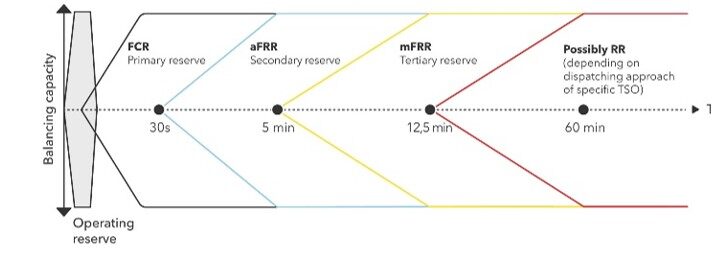

Additionally, frequency response AS are sometimes referred to as ’reserves’ or ‘balancing services’. Following ENTSO-E nomenclature, we categorise frequency response AS in the following:

● Frequency Containment Reserve (FCR) – operating reserves with short term activation time (up to 30 sec). Also known as Primary Reserve. FCR is typically remunerated as a capacity payment only.

● Frequency Restoration Reserve (FRR) – active power reserves available to restore system frequency with activation between 30 seconds and 12.5 minutes. FRR can be distinguished between reserves with automatic activation (aFRR) (up to 5 minutes) and reserves with manual activation (mFRR) (between 5 and 12.5 minutes activation). aFRR is known as Secondary Reserve and mFRR is known as Tertiary Reserve. In Europe, FRR is remunerated through both a capacity payment and energy payment.

● Replacement Reserve (RR) – Active power reserves available to restore or support the required level of FRR to be prepared for additional system imbalances, including generation reserves. Includes operating reserves with activation time from 12.5 minutes up to hours.

The different frequency response AS are illustrated below.

Figure 3 Illustration of frequency response AS

SOURCE: ENTSO-E

BESS, with ultra-fast response times (milliseconds), have a clear competitive advantage in providing FCR services and this the market where BESS have been generating the greatest share of revenues. Our review of European reserve markets suggest that secondary and tertiary reserve have offered up to 20% for battery revenues. This makes FCR and primary reserve the most important revenue source for BESS.

Ultra-fast response AS

With increased VRE integration, many TSOs have introduced services that require even more rapid response times than 30 seconds. Still considered FCR services, these specialised products are worth investigating in more detail as batteries are among the few asset classes that can meet the (often) stringent technical requirements to participant. Some examples in Europe include:

● GB: Dynamic Containment (DC) – Launched in October 2020 DC is an ultra-fast balancing service requiring sub 1 second activation. The market has traditionally cleared at a relatively high 17 £/MW/h (20.2 €/MW/h) and services were procured for 24-hour blocks on a pay as bid basis. In September, the auction mechanism changed to 4-hour blocks (in line with EU standards) with pay-as clear pricing. This has meant that batteries were able to be optimise their participation in the DC and wholesale market. The high volatility observed on the wholesale markets over recent months accentuated a trend away from DC and towards wholesale arbitrage. As a result, prices for DC have become more volatile ranging from 1.5 to 48.0 £/MW/h (1.8 to 57.0 €/MW/h)

● Ireland: Fast Frequency Response (FFR) – FFR service requires response within two seconds, but there is a premium payment for response within 0.15 seconds. As BESS can meet this response, this gives them a financial edge. It can also benefit wider economic system through investment in capacity providers that meet faster response time. Current FFR prices are clearing at 2.2 €/MW but extra fast premiums can triple this price.

● Italy: Fast Reserve – FCR is traditionally automatically provided by synchronous generators, but in recognition of increased flexibility needs with growing wind penetration, Terna recently awarded 5-year contracts to 250 MW of energy storage capacity in an oversubscribed pilot auction to procure ultra-fast (1 second) frequency regulation. The auction prices for this ultra-fast service ranged from 2.1 to 6.1 €/MW/h.

FCR as major BESS investment driver

In those systems where BESS penetration is already advanced, we observe that primary reserve markets are becoming saturated, driving FCR prices down. This reduces the importance of revenues in these markets. BESS operators may need to consider how to re-balance their revenue stacks in these markets. In those systems, where battery investments are lagging and VRE penetration is reaching critical levels, TSOs and regulators should carefully consider the design of AS markets and products. In particular, the introduction of fast response FCR products should be designed carefully to have a significant impact on BESS investment uptake.

This could go together with adequate capacity market provisions (eg duration of capacity payments and non-penalising derating factors), access provisions across all energy markets for BESS enabling revenue stacking and fiscal reform and/or network charging exemptions for wholesale energy trading.

[1] We use the term BESS in this Insight to mean grid-scale lithium-ion front of meter batteries.

[2] For example, Fast Frequency Response (FFR) in Australia and Ireland can be confused with Firm Frequency Reserve (also FFR) in GB.

Frederik Beelitz

Managing Director

Frederik, the author of this Insight, is Managing Director of ECA. Whilst his focus is on the interaction of gas and power markets, he is also supporting on renewable energy asset investments, battery energy storage systems and midstream gas infrastructure developments.

To contact Frederik directly please email or connect with him on Linkedin below.