ECA INSIGHT >>

Battery Energy Storage Systems (BESS) are on track of becoming an integral component of electricity markets around the world. Although investments for grid scale BESS are still at relatively low levels of US$3 billion per year, they are expected to rise substantially over the next decades.[1]

Historically, storage (mainly hydro pumped storage) was regarded as a generation asset by regulators and policymakers. New generation BESS technologies now offer a high degree of flexibility, which sees them offering ancillary services (reserves) in those markets where they are operating. With such an important role to play for grid stability, should BESS assets be considered network assets and be regulated as such? Or should BESS operators be allowed to participate in wholesale and secondary markets as any generator would? Answering these questions can help policymakers and regulators in prioritising the role BESS ought to play in power systems: reducing price volatility, offering reserve services or alleviating network congestion.

BESS value drivers

BESS assets can provide multiple services, each of which may be separately remunerated. They include:

● Arbitrage – buying energy in off-peak periods when prices are low and selling in peak periods when prices are high. This reduces total costs of supply by shifting surplus low-cost generation to peak periods and operators can earn revenues from the difference between off-peak (charging) and peak (discharging) prices. It also reduces price volatility on wholesale markets.

● Reserves – increasing supply to correct for frequency drops or increasing consumption to correct for frequency rises. This can be provided over a range of response times and for different durations dependent on system needs. Value is driven by earning revenues from capacity payments for reserve providers, selling services in a balancing market or obtaining regulated tariffs for these services.

● Investment deferral – providing system support services and absorbing excess supply. This part of BESS services avoids the need for investment in new transmission and distribution assets to relieve congestion by purchasing and selling energy at key grid locations. This can be done on a contract or merchant basis if BESS operators are licensed to do so. If operated by network operators (NO) who in most established regulatory regimes cannot act as merchant entities on the market, these operations are remunerated through regulated tariffs.

Experience in markets to date is that the most valuable revenue streams have come from providing reserves. However this is also the revenue stream most at risk from cannibalisation, raising questions about BESS investment recovery and one of the arguments of making it a regulated service.

BESS revenue models

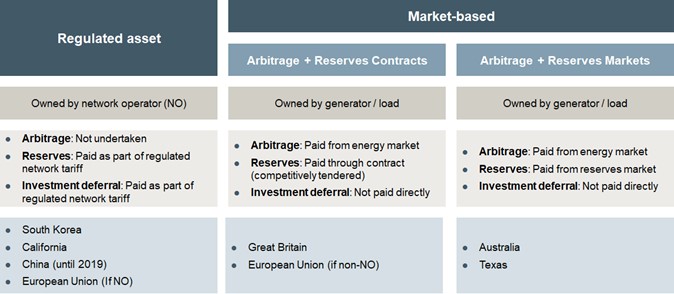

The role BESS plays in power markets will critically depend on (i) the ownership of the asset and (ii) supporting or secondary market arrangements such as reserves. This leaves broadly three revenue models as shown in Figure 1. Note that these models are not mutually exclusive and they can coexist as is the case in Germany for example.

Figure 1 BESS revenue models

In the “Regulated asset” option network operators (NO) own the asset and the cost is recovered through a regulated tariff. In unbundled regulatory regimes, like the European Union for example, where NOs cannot participate in wholesale market trading, this limits the asset to providing network services only – no arbitrage. Pilots in Germany (‘Grid boosters’) and France (‘virtual transmission’) among others are underway with the aim of avoiding costly network expansion. TSOs will be charging at one location and simultaneously discharging at another to not interfere with the market[2]. A number of interesting regulatory question arise from this model. Access provisions in particular will need to be developed. In France, the virtual transmission assets will initially be exempt from third party access. Under this option BESS is largely seen as providing network congestion management services.

The “Arbitrage + Reserve Contracts” option is primarily a market based approach, as operators of the asset can participate in wholesale arbitrage. Reserve service in this option are not purchased through a liquid market but through reserve contracts. Investment deferrals in this model are not paid directly but in markets with locational prices, congestion costs are forced into the energy price, which means that investment deferral is remunerated through the sale and purchase of energy at various key locations on the grid. The implication of this option is for BESS to mainly reduce price volatility and contribute to reserves.

The “Arbitrage + Reserve Markets” option requires a fully operational and functional ancillary service market. These are in place in Australia and Texas where system operators purchase various reserve services on day-ahead and intraday markets. For BESS operators this means no limitations on market participation and full flexibility in ‘stacking’ their revenues across optimised wholesale and reserve market trading. Price volatility can be reduced and reserve provisions will be priced more competitively.

BESS regulatory treatment to serve specific system operation objectives

BESS can provide multiple services that contribute to security of supply, reduced price volatility, system reserves and efficient congestion management. Any regulatory and (supporting) market design framework should ensure revenues for each service is accessible to operators in order to accelerate BESS investments. The definition of optimal frameworks will depend on the specific system requirements and the key role envisaged by BESS.

[1] The IEA estimates grid scale BESS capacity to grow 50 fold by 2040. IEA, Innovations in Batteries and Electricity Storage, Sep 2020

[2] this is due to prohibitions on TSOs trading energy in EU markets

Frederik Beelitz

Managing Director

Frederik, the author of this Insight, is Managing Director of ECA. Whilst his focus is on the interaction of gas and power markets, he is also supporting on renewable energy asset investments, battery energy storage systems and midstream gas infrastructure developments.

To contact Frederik directly please email or connect with him on Linkedin below.