ECA INSIGHT >>

Since deregulation of the supply market in the UK over two decades ago, the regulator has tended to leave it to the supply companies to decide the design of the tariffs charged to end-users. This has changed recently with regulatory interventions to limit the number of residential tariffs offered but in most other countries worldwide the regulators do concern themselves with tariff designs to regulated end-users as well as with allowed revenues. National Association of Regulatory Utility Commissioners (NARUC) in the US is updating its Electric Utility Cost Allocation Manual on how to allocate costs in electricity tariffs. The current version was issued in 1992 and recognised two broad approaches to cost allocation – marginal cost and embedded cost. While accepting the legitimacy of the marginal cost method, it recommended that US utilities adopt embedded cost. Marginal cost is, arguably, more common outside of North America.

This Insight examines the two approaches and considers how fundamentally different they are.

Allowed revenues versus tariff design

We should start by clarifying some terminology: allowed revenue, cost allocation, cost of service, and tariff design. Allowed revenue for a regulated entity is an amount of money that is, almost invariably, calculated to cover efficient operating costs, to return the investment on fixed assets, and to earn a reasonable return on that investment. This is all in financial/accounting terms rather than economic (more on the difference below). It is an amount of money that needs to be recovered per year for the entity to be financially viable and able to attract financing for new investments in the future when needed. We can think of this as an amount $X or an average $x per kWh across all customers. It can be for one year in the future, or for several years (multi-year allowed revenue or allowed average revenue).

The allowed revenue calculation is used as the starting point for tariff design or cost allocation to customers, irrespective of whether the embedded or marginal cost approach is adopted.

Tariff design, which is the subject of this Insight, is concerned with how the allowed revenue amount ($X or $x per average kWh) is collected from customers – how customers are categorised, what is charged as a fixed fee per month, per kW of contracted capacity, per kW of maximum demand, per kWh at times a, b, c, etc. The tariff designs should be arranged such that they achieve the amount $X (or $x per average kWh) based on forecasts of customer numbers and sales (kWh and kW per month or year) by time-of-use.

Tariff design is therefore concerned with the relativities between tariff components and between customer categories, not the absolute values.

Cost allocation with embedded cost is about how the revenues are allocated to different customer categories and is a step toward tariff design where the allocated cost is collected from customers through kWh charges, maximum demand charges, etc. With marginal cost analyses the choice of customer categories and the charges to those categories is just one of the characteristics of optimal tariff designs, and cost allocation is an outcome rather than a step. Although terminology becomes less precise when used outside of the US, “Cost of service” studies are concerned with cost allocation to customer categories but are not necessarily concerned with detailed tariff design.

The marginal cost approach

Electricity utilities are regulated because they have a captive market and there is no competition. Marginal cost pricing is essentially attempting to mimic the price that should emerge in a competitive market and in doing so this maximises ‘economic efficiency’[1]. Its application in the electricity industry was originally championed in France in the 1950s[2]. Starting from a baseline power system and associated costs, one simulates the impact on costs (including operating and capital costs either now or, if the increase in load is sustained, in the future) of a small change in load.

Marginal costs relating to fixed assets are more difficult to calculate but various techniques are deployed for this[3]. The resulting marginal costs are higher during system peak hours when the system is stretched and when additional load may mean that new investment is necessary to satisfy that load, and lower during off-peak hours. This results in higher marginal costs that are attributed to customers who consume more in peak hours and is used to create tariff designs with higher charges in peak hours.

But tariffs based purely on marginal cost (almost) never exactly achieve the allowed revenue $X. This is because they are forward looking and consider what investment is needed in the future, not what investment has been made in the past. The $X has been calculated based on past investments. So, the pure marginal cost-based tariff must be adjusted upwards or downwards such that it achieves $X. This ultimately achieves an allocation of the $X to customer types and by tariff component (kWh, kW, time-of-use, etc). Importantly, these tariffs deviate from the economic principle of marginal cost.

The embedded cost approach

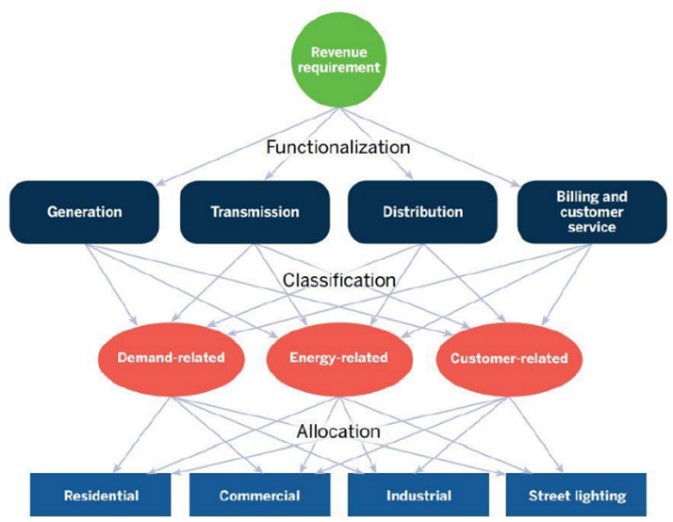

The embedded cost approach is more direct and involves three main steps: (1) splitting costs into functional components – production, transmission, distribution, billing, and customer service; (2) classifying these as demand-related (kW), energy-related (kWh) and customer-related; and (3) allocating these to customer categories based on their load patterns.

This is illustrated below:

These steps are actually very similar whether using embedded cost or marginal cost but with embedded cost they are applied directly to historical accounting costs rather than to economic and forward-looking marginal costs. The allocation of costs is acknowledged to involve judgement. The US Supreme Court famously noted in 1945 “Allocation of costs is not a matter for the slide rule. It involves judgment of a myriad of facts. It has no claim to an exact science”. This also applies to marginal cost designs but perhaps to a lesser degree.

How different are they in practice?

The marginal cost approach uses economic principles while the embedded cost approach is based on accounting principles. This inevitably result in different cost allocations and tariff designs.

It is no coincidence that marginal cost designs are closer to prices that should emerge when a market is liberalised. With the introduction of competitive markets and the unbundling of the electricity supply chain, the two approaches begin to merge. Where the wholesale generation market is competitive, the cost of electricity purchased by suppliers should be the marginal cost by time-of-use. The supplier and regulators will then generally wish to pass that cost on to customers and to structure the end-user tariffs to reflect, though not mirror exactly, wholesale prices. However, network components are considered natural monopolies and tariffs must continue to be regulated. A decision must therefore still be made on whether to use embedded or marginal cost approaches for network pricing.

[1] It is one of the foundations of economic theory that in a competitive market, price is equal to marginal cost.

[2] See Turvey, R. and D. Anderson (1977). Electricity Economics: Essays and Case Studies. Baltimore: John’s Hopkins University Press.

[3] There is a large body of literature on long-run and short-run marginal costs and how they should be calculated.

Grigorios Varympopiotis

Managing Consultant

Grigorios specialises in electricity tariffs and tariff design with more than 10 years’ experience worldwide. He has advised more than 15 utilities and regulators on tariff regulation, allowed revenues, tariffs and tariff designs. His background is in Mechanical Engineering (BSc, MSc) and Economics (MSc). Grigorios also specialises in power sector development planning, demand forecasting and due diligence studies for power plants.

To contact Grigorios directly please email or connect with him on Linkedin below.