ECA INSIGHT >>

The Israel electricity sector is undergoing substantial changes. Most notable, the Government of Israel (GoI) is introducing reforms to create competitive markets both on the supply and retail side. Modelling the Israeli Electricity Market at a unit level using PLEXOS Software, we identify shortcoming and inefficiencies in the current functioning of the power market. Our results show that market operation rules need to change in order to ensure generators are remunerated appropriately in the market and that no perverse investment and bidding incentives remain for generators.

Ongoing liberalisation process…

The GoI is pursuing a reorganisation of the power sector to introduce wholesale competition, increase security of supply and expedite the introduction of clean energy sources. This consists of breaking up the quasi-monopoly of state-owned Israel Electric Corporation (IEC) across generation, transmission, distribution, and supply. The measures taken so far include:

● The creation of a competitive wholesale power market in 2018 operated by a new independent System Operator (SO).

● The incremental divestment of 4.5 GW of IEC gas plants to independent Power Producers (IPP) by 2023[1]

● Phasing out of all coal units by 2028 with restricted operations in line with environmental emission targets.

…with inefficient market operation

The power market currently operates as a gross pool[2] relying on a two-settlement market process (day-ahead and real-time) and is overseen by the SO, acting as a central dispatch authority. The market currently features some idiosyncrasies however:

(i) the price settlement is not based on the marginal unit but on spinning reserve units;

(ii) IPPs are allowed to bid their part-load capacity outside of the market;

(iii) There is an uncertainty around how units under the management of IEC are and – crucially – will be dispatched into the market.

While there are legacy reasons for these characteristics to be in place[3], the resulting market outcomes and associated requirements for out-of-market transfers jeopardises one of the benefits of competitive markets: efficient investments. We put the spotlight on three inefficient market outcomes in this ECA Insight.

Inefficient outcome 1 – day ahead prices do not reflect true cost

In countries with established competitive wholesale markets, the price is set by the marginal unit generating electricity, i.e. the most expensive unit called to operate to meet demand at any point in time. Any generator generating at a more competitive price than the marginal unit is ‘in merit’, dispatched and obtains a margin on its cost.

In the Israeli day-ahead market, the plants being dispatched, are the ones with the lowest daily cost which includes start-up cost, cost for running at minimum load and bids for the incremental energy above the minimum load. The dispatch is calculated by minimising the costs of generation based on demand projections and generator offer prices and availability. The resulting System Marginal Price (SMP) is determined with different rules than in established competitive gross pool markets: The SMP is determined based on the cheapest incremental offer of a part-loaded unit also providing spinning reserve.

This means that generators operating at the margin at any given half hour may not be able to recover their costs, since the least cost reserve plant may have operated at lower cost. The differential of the SMP and the cost of a plant at any given half hour needs to be remunerated outside of the market. Consequently, ‘make-whole’ payments are used to guarantee operating costs recovery for power plants operators. This approach may result in limited opportunities for revenues in the spot market.

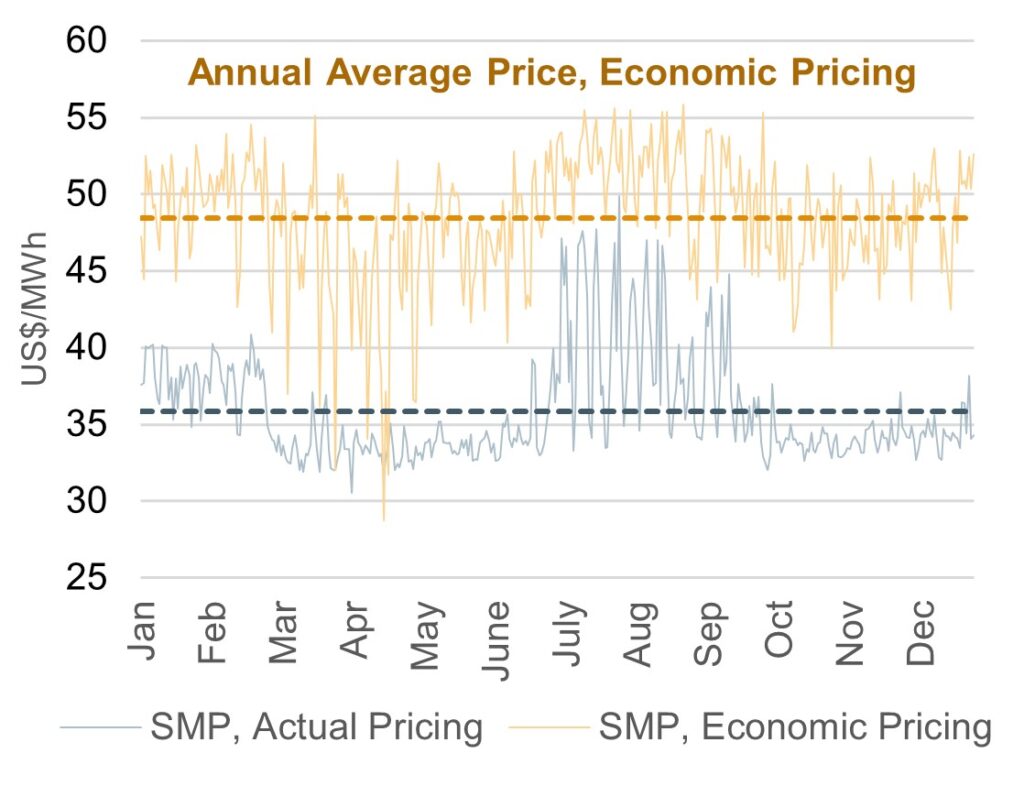

We have modelled the Israeli market with Plexos Market Modelling Software on a unit-by-unit and hourly level to project two market outcomes for 2021: (i) ‘Actual’ SMP, under the current settlement rules; (ii) ‘Economic SMP’ under a traditional ‘economic’ gross pool pricing, as in place in established competitive markets.

The simulations show the ‘Economic SMP’ to be consistently and significantly higher than actual SMP in 2021 – on average almost 30% higher. This means that out of market remuneration (‘make-whole payments’) are high and will remain so if the market mechanics are not adjusted.

Besides burdening fiscal budgets the outcome does not create the right investment incentives.

Figure 1 Daily Baseload Prices – 2021

Source: ECA Israel adjusted PLEXOS model

Inefficient outcome 2 – IPPs have an incentive to bid above marginal cost

Not all available capacity is participating in the pool. This further contributes to market distortion: IPPs can partly operate outside of the market and therefore not contribute to the SMP. IPPs with excess generation not taken off from their bilateral contract partners can bid (and be scheduled) into the market. The issue with this, is that there is no incentive for them to bid anywhere near their true marginal cost. This means that they can ‘game’ the system by bidding above or below their marginal costs resulting in uncompetitive outcomes for consumers.

Inefficient outcome 3 – IEC units ‘protected’, crowding out IPP revenue

A pre-determined number of units will remain under the management of IEC for strategic purposes , There is an uncertainty around how the SO will deal with these units:

(i) Coal units are not dispatched on an economic cost basis but instead are dispatched on the basis of security of supply and environmental constraints with partial load operating as must run and the remainder as part-load capacity after some thermal plants have been dispatched.

(ii) Peaking units (Industrial jet gas and diesel turbines) are also subject to environmental constraints. These units are considered as ‘last recourse’ units.

(iii) Newly commissioned hydro Pumped Storage plants will be operated by IEC with plans to operate these plants to accommodate the high renewable penetration. The impact could mean a reduction of reserve requirements for other generators.

(iv) Coal plants converted to steam gas turbines and CCGTs will be operated by IEC. It is not clear how IEC will operate these plants in future and how the SO will treat them. One possibility is for these units to operate at minimum stable load during the high demand season to meet security of supply requirements. This would inevitably have an impact on the level of reserve provided by other plants.

In combination these factors could have a significant impact on future revenues of IPPs in the market by (i) influencing the SMP and (ii) crowding out private generation. GoI and the SO need to provide clarity on how these uncertainties will be addressed.

Towards a fully competitive market design

The existing set-up results in inefficient scheduling outcomes and prices that are below cost recovery level. This does not set the right incentives to deliver efficient short-term operation and long-term investment price signals for future capacity investments. It also means out-of-market settlements are needed to compensate losses for generators, which ultimately have to be paid by consumers. Moreover, private market participants are exposed to significant regulatory risk: rules under which IEC plants will be operated still need to be clarified.

A move towards clearer market rules, a dispatch based on marginal cost only and market based mechanisms to ensure security of supply (eg setting up of a capacity market) would allow market participants to form efficient bidding strategies in the short-term and make informed investment decisions in the longer term.

[1] Two sites (representing 1.7 GW) – Alon Tavor in 2019 and Ramat Hovav at the end of 2020 – have already been successfully tendered.

[2] Conventional competitive power markets come in two main variants: (i) gross (mandatory) pools, where generators bid to sell, and customers or suppliers offer to buy, electricity from a pool; (ii) bilateral contracting markets with net pools (balancing markets).

[3] And a policy objective of meeting overly stringent security of supply criteria.

Nicolas Jacob

Senior Consultant

Nicolas is an economist specialised in power market due diligences and long-term energy supply strategies. He has experience advising governments, regulators and private companies across the EU, Sub-Saharan Africa, the Middle East and Asia.

To contact Nicolas directly please email or connect with him on Linkedin below.