ECA INSIGHT >>

Complexity is no excuse to ignore economics when setting net zero targets

October, 2019

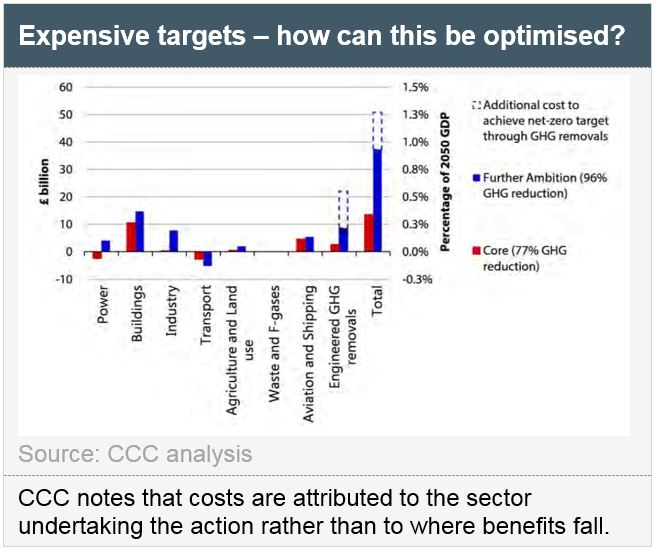

UK government policy is now targeting zero carbon emissions by 2050. This requires specific interventions that could be very expensive. A least cost or least regrets analysis framework is therefore required to minimise the burden for society. However, the UK government’s climate policy advisory body, the Committee on Climate Change (CCC), considers the orthodox approach to evaluating such a policy – a Cost Benefit Analysis (CBA) – to be totally unsuitable in this case [1]. This seems a premature conclusion.

Cost Benefit Analysis in policy planning

A CBA model is essentially a discounted cashflow analysis (DCF) like any other investment decision. It differs from commercial investment modelling in two ways:

- Valuation of externalities. This process monetises costs and benefits that would otherwise not impact on a financial model that only concerns the return to the investor; carbon emissions are an obvious such externality in this context.

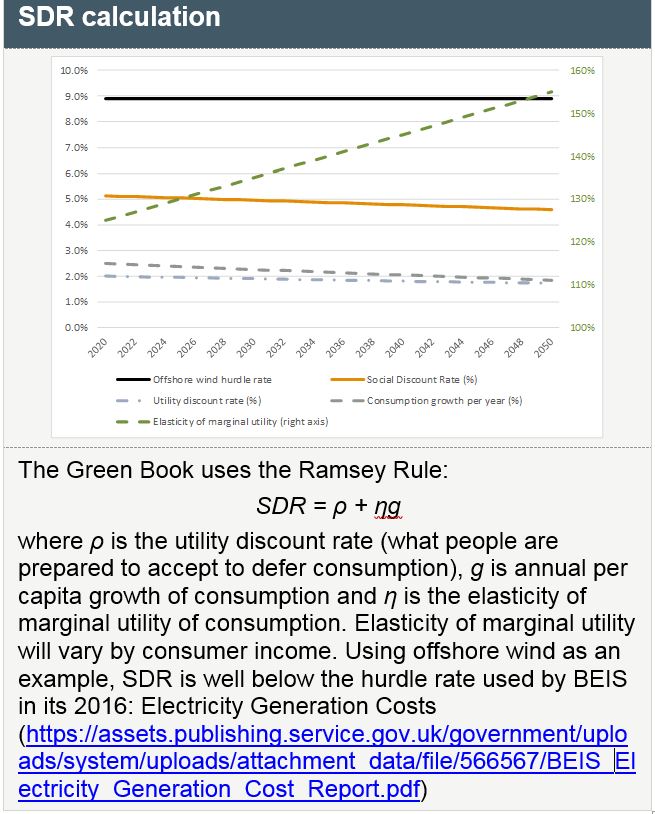

- Social Discount Rate (SDR). This values the consumption of future generations to the present investors – how much are we prepared to pay for our children’s welfare rather than how much future revenues are worth to us? It can be used to determine if the Net Present Value (NPV) of an investment is positive from a social rather than investor perspective.

This model of CBA is specified in the so-called Green Book on policy and investment evaluation used by the UK Government and is a reasonable way of evaluating individual policies or government expenditures.

How these two factors are valued is important. Estimates of the marginal value of carbon vary widely between government, market and academic sources. Externality costs can also vary over time (The HM Treasury Green Book supplement [2] gives a non-traded valuation of carbon as £67/tCO2e for 2018 rising to £231 by 2050). The value of carbon abated is a function of how much still needs to be done to achieve the pathway to target – the carbon value is not a constant.

The Green Book also gives a rationale for the chosen SDR (currently set at 3.5% but not updated since 2008 [3]). The inputs to this require assumptions and are not uniform over time or between individuals (marginal utility for instance differs between those who can afford rooftop solar PV and those who can’t) but estimation is possible.

CBA for zero carbon needs a scenario approach

All the above suggests that a standard CBA model designed for specific policies or investments will not be sufficient. The zero-carbon target is in reality a whole mix of policies and initiatives with several variables to consider:

- Policies are interlinked. The value of carbon saved from energy efficiency measures is reduced if heat supply is decarbonised through hydrogen networks, for example – least regrets is not achieved by looking at each policy in isolation.

- Costs of any technology are dependent on rate of deployment. When investments are made the rate of investment will affect the cost of further investments as has been seen with costs of solar panels.

- Costs could affect future incomes. The scale of investment required will affect capacity to pay in future years – this (as explained below) affects the Social Discount Rate.

For these reasons, a CBA model requires a scenario approach that projects different mixes of pathways to zero-carbon.

But how do we measure optimisation for a CBA?

The scenario with the highest NPV should be the favoured policy mix. However, different approaches are also possible and what if no positive NPV is identified? We have conceived three over-arching approaches:

- Value of carbon abatement. This seeks to value all externalities of carbon emissions at the cost of achieving zero emissions rather than at the external losses of those affected by those emissions. In modelling terms, this would not allow the value of carbon abatement to vary over time and so gives no information as to the optimal pathway to emissions reduction. It is likely to front-end investment costs.

- Social Discount Rate. This could go negative. There is no objective rationale for adjusting this other than to achieve a pre-set target (NPV = zero). The defects include an inability to adjust SDR over time and a likely front-loading of investment costs.

- Zero-carbon benefit. This objectively sets carbon pricing and SDR based on existing methodologies (as explained in the Green Book). A separate but arbitrary value would be added to the revenue stream in each scenario representing the minimum benefit needed to achieve net zero. The optimum scenario would be the one with the lowest added revenue required – the one with the lowest necessary subsidies.

A CBA model remains the way forward

While we agree that traditional technology-specific CBAs are not appropriate, the role of economics should not be downgraded in evaluating pathways to net zero. A scenario-based DCF model using existing techniques and recognising interlinkages between policy measures and technologies can help identify the least burdensome route to achieving the goal.

Zero-carbon is a political decision. This will entail costs, which must be quantified and minimised. This requires sophisticated supporting analysis, the details of which we intend to explore further in future insights.

[1] Committee on Climate Change: Net Zero The UK’s contribution to stopping global warming, May 2019, https://www.theccc.org.uk/wp-content/uploads/2019/05/Net-Zero-The-UKs-contribution-to-stopping-global-warming.pdf

[2] Valuation of Energy Use and Greenhouse Gas, 2019 update https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/794737/valuation-of-energy-use-and-greenhouse-gas-emissions-for-appraisal-2018.pdf

[3] Intergenerational wealth transfers and social discounting, 2008: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/193938/Green_Book_supplementary_guidance_intergenerational_wealth_transfers_and_social_discounting.pdf