ECA INSIGHT >>

Batteries: modelling value in alternative markets

Oct, 2018

Electricity storage devices are widely expected to become the must-have add-on to electricity systems increasingly supplied by intermittent renewables. As battery technology has rapidly come down in price, deployment to provide fast-delivery ancillary service has reached saturation. The future value of batteries will increasingly be determined by revenues from other markets. This insight sets out the economics of these markets and explains how pricing in alternative markets can be derived and how ECA models the resulting revenue streams for batteries.

Option economics

Batteries are a physical option to deploy a limited amount of energy in response to price fluctuation. Physical options offer physical limitations but underlying pricing is not fundamentally different to valuation of financial options; the option fee represents the opportunity cost of being exposed to price fluctuations.

The market for physical electricity options is highly competitive; stored electricity does not have an inherent advantage over stored gas or coal converted to electricity by a conventional power station.

For physical electricity, the option can be passed to the TSO as an ancillary service in exchange for a fee that covers the fixed cost of investing in the capacity.

Without sales as an ancillary service, an option provider is forced to retain the option and to trade it on a merchant basis. This potentially has the advantage of widening the pool of purchasers beyond just the TSO (although not if the wider market is the balancing market) but merchant revenues must cover both operating costs and the option fee needed to recover investment costs.

For storage devices, optionality occurs at two points: generating and refilling. Pumped storage operates by offering the market peak shaving capacity with the benefit of filling the trough period as well. This is useful in nuclear-dominated markets because markets with a lot of inflexible baseload plant are vulnerable to both peak shortage and over-delivery during overnight troughs.

Pumped storage can currently work reasonably well offering optionality to the whole market in day ahead timeframes because the requirement has tended to be for management of largely predictable load variations from consumer demand. But, with variation increasingly driven by forecasting error around wind and solar generation, offering in a day ahead market is less attractive: more prompt flexibility is now needed.

Both pumped storage and batteries operate on the same economic model. Energy should be sold whenever the price of replacement energy is predicted to be low enough to offer a margin that covers efficiency losses in operation (with current technology, electricity price spreads need to be at least 20% for both pumped storage and batteries).

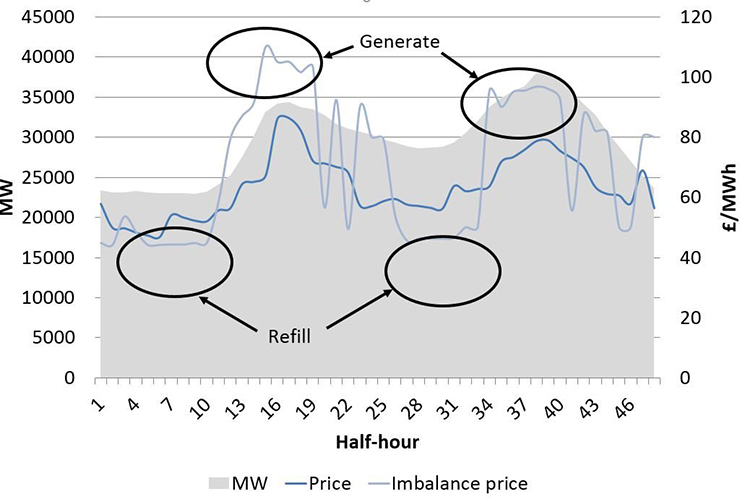

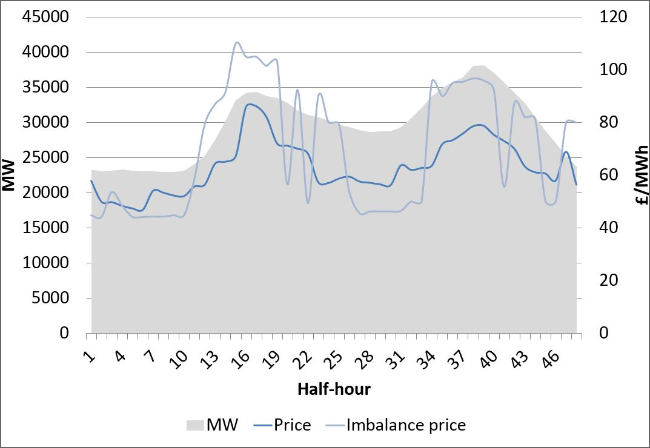

Figure 1 Demand and prices

Batteries: modelling value in alternative markets

Figure 1 shows the basic economics of a battery or pumped storage merchant arrangement on an October weekday. Using imbalance prices, there is a clear buy and sell cycle twice a day; using day ahead prices, there is less certainty of sufficient price spread but greater certainty of trading in those hours. In the case of batteries, the price spread has to be still greater to offer a margin that repays fixed costs as well as efficiency losses during operation.

Batteries are different from pumped storage in one important respect: scale. While pumped storage can hedge positions across the generation cycle by not releasing all its capacity in one go, batteries are small and will effectively need to release all the energy in one go to make a meaningful offer to any user. Even with an array of batteries, the decision on any one unit in the array is to release all available power so the economics of each unit is the same: a one-shot deal that cannot be repeated until the unit is recharged.

Alternative markets

Hitherto, TSOs were prepared to pay a premium for rapid response that ensured frequency stability. With this requirement saturated, batteries need to find markets valuing other components of flexibility. Wind and solar intermittency does not actually cause excessive frequency instability, but rather they create a risk of energy shortage or surplus due to forecasting error. This means that these intermittent sources primarily drive a need for additional balancing energy that can be deployed reasonably quickly rather than instantly. The revenues and value of batteries will mostly arise from offers in:

- the intraday market and

- the balancing market

But imbalance is also an option. Operating the storage device without instruction from the TSO will lead to the resulting imbalance being sold (or bought) at the imbalance price, which can still be a favourable price; this is a commercial strategy: imbalance payment is still a form of trade.

For a battery with more limited storage (longer duration batteries are now being deployed but they face similar problems), operation in the day ahead market is not, in any case, practical: the decision to buy must come before it is known whether the option needs to be exercised. This moves decisions towards the less liquid intraday market or the balancing/imbalance markets.

The intraday market is promising for battery operators because it trades closer to real time and pricing will tend towards imbalance pricing. But it is an illiquid market, making reliance on prices arising from it risky. For modelling purposes, the intraday market, which is priced purely on avoidance of imbalance exposure, can be treated the same as the balancing market: the pricing fundamentals are the same.

The balancing market (BM) offers challenges as well as opportunities. It trades when the TSO needs correction of forecasting errors and, with wind forecasting error being high, the system cannot reliably be short or long in any trading period. However, as Figure 1 indicates, there is still reasonable predictability of pricing meaning that reserve prices for the storage operator’s offers or bids in the balancing mechanism could see a high probability of acceptance over a target range of hours.

Then there is the ‘imbalance market’. Over a period where the system is expected to be short, spilling energy can be profitable and offers the marginal price of energy, unlike a BM offer acceptance that will only pay the offer price. Similarly, recharging the battery during a period when the system is expected to be long will allow purchase at the low marginal price. This is a risky strategy if the market does not go long or short as predicted and equally, being a price taker in the market may not set the targeted price for profitable operation.

Thus both the balancing market and the imbalance strategy offer valid trading opportunities for a storage provider. A battery operating as a price taker in these markets may well find a profitable strategy but if all battery units do the same then the price profile could change; although profitable, it is not a risk free strategy.

Modelling battery pricing and valuation

Like any other investment in the generation market, a battery is worth the revenue stream derived from the margin over costs. In the case of storage devices, that margin is derived from the shape of prices in the market.

Most commercial pricing models offer a reasonable day ahead market price forecast across the year for a price-taking investor to assess revenue streams. However those models tend not to value market margins in an oligopolistic pricing situation and they do not usually model expected returns in a balancing market. ECA is building on its Wairoa dispatch model to offer both these attributes as well as accounting for how batteries might alter the dispatch profile itself including the impact on prices. Wairoa will provide a specialist battery trading module designed to capture profit opportunities for a reasonable optimised strategy.

Battery technology has the ability to be scaled up rapidly. This is why new markets are needed and why careful pricing is required for any investor’s business case.