ECA INSIGHT >>

The price for solidarity: gas valuation during disruptions

Aug, 2018

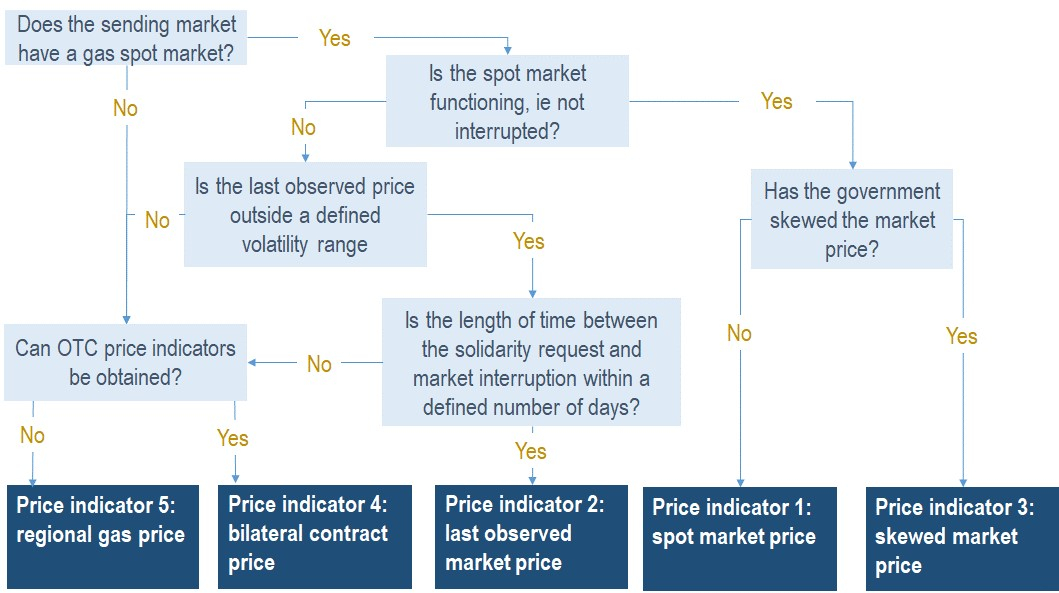

European legislation [1] foresees a solidarity gas agreement between member states in case of a supply disruption. In February 2018 the European Commission released a recommendation on solidarity gas pricing [2] instructing it to be set at competitive market levels. However, such reference prices may not always be available while proxies will depend on the specific circumstance of the disruption and nature of the market disrupted. This insight presents ECA’s tool for flexible pricing of solidarity gas with the aim of answering the question: how should solidarity gas be priced?

Solidarity gas requires a flexible pricing methodology

In the event of a disruption of a gas supply to an EU member state (MS), one of its neighbours’ may supply it with solidarity gas. The price for the gas should capture the market dynamics at the time of the request; however, a market price may not always be observable. The solidarity gas agreement that the countries share must therefore be able to price gas, whatever the state of the market and circumstance of disruption.

First best option: market price

If possible, the price of solidarity gas comes straight from the spot market in the sending MS. This price will react to supply shortages, making it a fair reflection of market conditions. Should the spot market have collapsed as a result of the supply disruption, last observable prices should be applied.

Second best: skewed market prices

The last observed prices from suspended spot markets are still reflective of market conditions if they are sufficiently recent and if market volatility rose before suspension, in anticipation of the impending supply disruption. A disruption severe enough to lead to a breakdown of trading would likely be sustained. Similarly, skewed spot markets, eg where government has capped prices in response to a disruption in the sending MS, also provide an indicator. While directly using the skewed price does not fully reflect supply conditions, is it preferable to working out the theoretical market price, as it avoids discriminating between foreign and domestic consumers, and non-competitive trading complicates the calculation of an accurate price.

Indicators outside of the spot market are available as a last resort

If the spot market broke down too long ago to be informative, or indeed never existed, we turn to the highest Over the Counter Market (OTC) price from bilateral contracts of non-protected customers. These are typically linked to oil or gas hub prices and give the marginal price of gas. The contracts are not in the public domain and customers may not be willing to share them; however, they have an incentive to reveal them to ensure they receive sufficient compensation. When they choose not to, prices are based on a neighbouring market, ranked using historical correlation of spot market prices or a measure of interconnectedness like capacity booking. Generating a ranking of markets in the region means there is a price indicator available even if the next MS also faces severe disruptions.

A ‘decision tree’ tool to structure solidarity gas agreements

The decision tree in Figure 1 determines which of these pricing indicators applies. It should be applied during solidarity gas agreement negotiations as well as during sustained supply disruptions, so that prices are always reflective of market conditions during disruptions. Exact details will be determined by the solidarity contract negotiations and must consider aspects such as additional transportation costs and the replacement of strategic storage. The decision tree, however, offers the overall structure of a contract which is always able to price solidarity gas. It reflects market conditions as closely as possible, whatever the severity of the supply disruption.

[1] Article 13 of Regulation (EU) 2017/1938

[2] Commission Recommendation (EU) 2018/177

Figure 1 Decision tree for solidarity gas price indicators