ECA INSIGHT >>

The pursuit of liquidity: has Europe got it right in electricity?

Jun, 2017

The European Target Model for the electricity market emphasises market coupling – to bring cross-border competition – and a liquid day ahead market (DAM) to set a reference price for trading. While cross-border access reduces structural impediments to competition, the relative importance of liquidity specifically in the DAM is open to question; suppliers and new entrant generators value forward coverage at least as highly. This should also be looked at with respect to the two main approaches to forward markets: in the Nordic area, forward markets are financial only, with physical energy not traded until the DAM, while in continental Europe, physical forward contracts are allowed and the DAM becomes a residual market.

Is the European emphasis in the day ahead and intraday timeframes correct or should more consideration be given to markets in other timeframes?

How are prices set?

Short-term prices are driven by avoided cost of imbalance; prices in the intraday market and DAM will very much reflect expected imbalance prices, with forward prices in turn also influenced (but not ultimately determined) by expectations of average DAM prices. Volume risk in these markets is also important. But this is only part of the story. Generators will price to recover costs, both short run marginal costs and a contribution to fixed costs; this applies in all timeframes.

So why contract forward?

Although a forward contract protects against exposure to spot market price spikes, the cost to suppliers of normal short-run volatility in the DAM is low: a supplier billing customers monthly is not much concerned about hourly price variations. A forward contract is actually more about hedging against movement in underlying prices; if average prices move (due to a change in generation costs for example such as an increase in, say, gas prices) then the hedge protects the supplier’s margin allowing it to sell retail contracts forward; generators will need similar protection against underlying price movement. The underlying price drivers for forward markets are different to those of spot markets.

Physical or financial forwards?

Physical contracts can take a variety of forms but fundamentally set a price for delivery at a future date. Although this price hedging is paramount, there is value in volume flexibility as well as price formation flexibility; a physical forward contract can offer both Buyer and Seller risk coverage through Economic Consulting Associates – Viewpoint 2 optionality: separate payment for availability and delivered energy, or renomination rights. The physical contract also allows the pass through or sharing of fuel price risk. However, this flexibility reduces tradability of the contract on secondary markets.

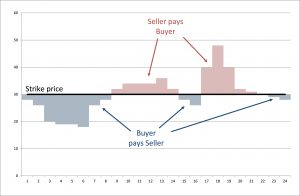

Typically, a financial forward contract would be a Contract for Difference (CfD). This sets a strike price, which is what the parties expect to pay or be paid and is settled against the DAM price. This means that, if the DAM price is above the strike price then the Seller pays the Buyer the difference whereas a low DAM price would see the Buyer paying the Seller the difference. Figure 1 gives an example of how a CfD works.

Figure 1 – How a CfD works

The strike price is an effective hedge against DAM volatility but is actually just providing the benefits of a forward physical contract. Terms in financial contracts can be adjusted to mimic those of physical contracts but with the same loss of tradability in secondary markets; financial forwards offer no intrinsic liquidity compared to physical forwards.

Is DAM liquidity vital?

Parties to a forward contract – physical or financial – that sets the price and apportions risk are largely indifferent to the DAM price outcome. Therefore, creating a liquid physical market in the DAM will not necessarily enhance competition as much as is claimed. It is true that a manipulated DAM price will destroy trust in the forward market as well (a dominant party in the DAM will be able to also dominate forward prices; but dominance only in forward markets cannot be effective because counterparties can just revert back to DAM trading). But liquidity in the DAM only needs to be sufficient for a reasonable reference price to be set and is not vital as a traded market per se.

It is forward hedging that is important for market contestability because it allows suppliers to contract forward in the retail market and allows new generators to secure financing for investment.

The EU Target Model has put great emphasis on liquidity in day ahead and intraday markets but should perhaps focus more on liquidity in balancing and, particularly, forward timeframes in order to increase competition from new entrants.