ECA INSIGHT >>

Cost-reflective[1] charging has long been the bedrock of Ofgem’s regulatory approach, a principle designed to send the right signals, allocate costs fairly, and keep the energy system efficient. But as fixed network costs rise and standing charges climb, this principle is under strain.

What happens to efficiency if we move away from price-reflectivity? Are we edging towards a model where policy objectives override market signals? And if so, are we drifting from a price-led, marginal price system toward something more centrally planned and redistributive?

These are not just technical questions about tariff design. They go to the heart of how Britain wants to finance its energy transition: through prices that reflect cost, or through mechanisms that pursue wider social goals at the expense of efficiency.

Ofgem’s consultation is about more than just standing charges

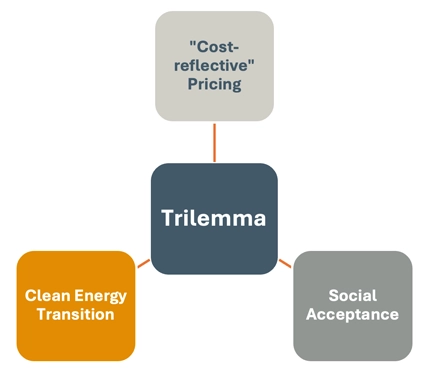

Ofgem’s new consultation – Energy System Cost Allocation and Recovery Review comes against a backdrop of rising network investment and a changing cost structure for energy bills. As the share of fuel costs declines and infrastructure costs grow, more of the system’s expenses are recovered through standing charges. For consumers, this means paying more simply to remain connected, regardless of how much energy they use; a feature already viewed as unfair by many households. The risk is a political and consumer backlash that forces policymakers into trade-offs: between keeping prices “cost-reflective”, ensuring social acceptance, and supporting the clean energy transition – the trilemma.

Figure 1 Trilemma of trade-offs

Source: ECA

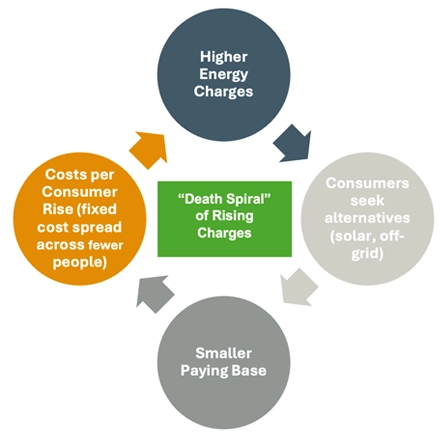

Yet tackling standing charges by simply shifting more costs onto volumetric rates is no easy fix. Higher unit rates risk triggering a death spiral dynamic (see Figure 2): as energy becomes more expensive per kilowatt-hour, those who can afford alternatives – rooftop solar, batteries, or even partial off-grid solutions – reduce their reliance on the grid.

The fixed costs of maintaining networks, however, do not shrink. Instead, they are spread across a smaller pool of consumers, pushing charges higher for those left behind; typically, lower-income households least able to invest in alternatives. In this way, well-intentioned moves to address fairness can entrench inequalities and undermine long-term cost recovery. Distorted price signals may also discourage investment in lower-carbon options such as EVs and heat pumps, compounding the problem.

Figure 2 Death spiral of rising energy charges

Source: ECA

The Efficiency Rationale

“Cost-reflective” pricing is valued for its efficiency: in retail tariffs, it signals the true cost of consumption at the margin, guides investment in flexibility and storage, and avoids cross-subsidies that distort behavior.

In Great Britain, this has meant a compromise, standing charges for fixed network costs, unit rates for variable costs, with government subsidies and tax measures handling redistribution. But with today’s pressures, the question is whether this blend is breaking down. If bills are meant to be “cost-reflective”, yet taxation and subsidies are already doing the work of redistribution, why is the outcome still proving politically and socially unacceptable?

The Ofgem Consultation

Ofgem’s consultation floats two broad directions: shifting more fixed costs into volumetric charges (whether through a single unit rate or block tariffs) or linking standing charges to proxies for income or wealth. Both would move away from pure price-reflectivity towards explicitly social objectives.

- Ofgem presents these reforms primarily as ways of improving affordability and fairness but gives less attention to their potential impact on efficiency. For example, the consultation recognises that different approaches could redistribute costs across consumer groups, but it does not fully explore how altered price signals might influence investment in low-carbon technologies or demand-side behaviour. In this sense, the review places more weight on the distributional dimension of charging reform, while leaving open questions about long-term efficiency effects.

- The consultation also blurs another distinction. Ofgem does not set household tariffs directly: its role is to set the parameters of the statutory price cap, below which suppliers are free to design their own tariff. In principle, this could mean a menu of offers: one tariff with higher standing charges and lower unit rates, another with the reverse balance, or more innovative combinations. Framing the review as if Ofgem is choosing a single “right” tariff risks overlooking this flexibility.

Where are we then?

The review leaves us with more questions than answers. Are price-reflectivity or market-reflectivity still the right lodestars for tariff design, or do today’s affordability pressures demand a recalibration? Should social support be embedded within tariffs themselves, or left to the welfare and tax system?

There are long-term risks in either direction. Diluting efficiency signals now may lock in distortions that raise overall system costs. Yet clinging too tightly to efficiency could deepen inequalities and provoke a political backlash that makes reform harder later.

Ofgem’s consultation is therefore about more than standing charges and volume tariffs. It forces a larger conversation: in the next phase of the energy transition, what role should cost-reflectivity play and how much are we willing to trade it off against social and political priorities?

[1] Here “cost-reflective” is shorthand for prices that reflect marginal costs. More strictly, these are “price- reflective” signals, since they are shaped by wholesale markets, policy interventions as well as potential scarcity rents.

Mehak Vohra

Analyst

Mehak Vohra joined ECA in August 2025 after completing her MSc in Economics at LSE, where she specialised in quantitative economics and applied econometrics, with research on trade, industrial, and environmental policy, expertise in statistical modelling, and a dissertation on Chinese import competition’s impact on U.S. manufacturing employment.