ECA INSIGHT >>

Electricity mini-grids: how should costs be regulated?

May 2017

In a previous article, we discussed whether policies will allow cost-reflective tariffs for isolated and grid-connected electricity mini-grids in developing countries*. Less attention in policy-making circles has been placed on how ‘reasonable’ costs should be calculated. In this note, we outline a methodology for determining such ‘reasonable’ costs, and identify challenges for implementation.

The building blocks approach for national utilities provides guidance

Regulators may apply the ‘building blocks’ approach to assess a national utility’s allowed revenue. The approach adds three ‘blocks’ of costs:

Operating expenses

+ Depreciation

+ Financing costs

= Allowed revenue

This annual allowed revenue is divided by forecast energy sales (in kWh) to give an average tariff, which guides tariff calculation. This calculation could incorporate multiple years of allowed revenue and energy sales to derive a multi-year tariff.

Accurate determination of operating expenses is often overlooked

Operating expenses are those fully expensed within one year, and which do not contribute to the asset base of the mini-grid, e.g. fuel, staff, maintenance. Of the three building blocks, the methodology for determining operating expenses is arguably the most straightforward but often the least discussed; many costs can potentially be benchmarked to assess their reasonableness.

Depreciation is more complex

The allowance for depreciation provides cash to recover the principal (debt and equity) used to finance the asset base. Alternatively, the cash from depreciation allowances could be used to cover future capital expenditures, in lieu of additional financing.

The calculation involves two factors: the asset base being depreciated, and the rate of depreciation.

The asset base typically includes those assets that are not ‘customer-specific’, so does not include connection costs financed by the customer. These may either be recovered directly from customers up-front or over a period of years. Project development costs may be capitalised in the asset base.

In theory, the rate of depreciation should assume asset lives that match the useful life of the assets, so that customers pay for what they ‘consume’ of the assets. The market for financing mini-grids remains immature, and financing terms are typically much shorter (5-8 years, or less) than those for national utilities and a mini-grid’s assets’ useful lives. This mismatch may result in an insufficient cash allowance to cover principal repayments.

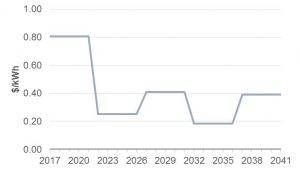

Regulators can ‘accelerate depreciation’, or allow a cash recovery matching debt principal repayments instead of the depreciation allowance, to mitigate the effects of this. The risk of either approach is shown in Figure 1, where accelerated cash recovery may result in a lumpy average tariff profile as assets are fully depreciated before they are replaced.

Figure 1 Tariff profile with accelerated depreciation

A benefit of the depreciation approach for isolated mini-grids (in addition to resulting in a more market-based tariff for consumers) derives from the calculation of the asset base, which may be used as the basis for compensation if the main grid arrives. If depreciation is accelerated, the compensation payment and value accretion to the asset base of the main grid utility become more complex.

Financing costs in an immature market

Financing costs (both debt and equity) are assessed by multiplying the weighted average cost of capital by the regulated asset base. The regulator will determine a reasonable level for each of these, balancing both operators’ and consumers’ interests.

The immature market for mini-grid financing means benchmark costs for debt and equity are hard to identify. Comparisons with both small-scale grid-connected renewable generation and stand-alone product distributors do not accurately reflect the asset type and customer risks of a mini-grid.

When assessing the financing costs for a large utility, it is typically assumed that gearing and financing costs are relatively fixed over time. A mini-grid is likely to have major changes in its capital structure between grants, equity and debt, and the costs of each, as it goes through a project life cycle from planning, development, early operation, and steady state operation.

Mini-grids regulation can learn from its big brother

While regulation of mainstream electricity grids builds on years of experience, there is comparatively very little experience of regulating mini-grids. Where mini-grid tariffs need to be regulated, main grid approaches may be used, provided differences are recognised.

* This Insight follows one published by ECA in February 2017 on the necessity of cost-reflective tariffs for mini-grids in developing countries.