ECA INSIGHT >>

Regulators often view the inflation of the Regulatory Asset Base (RAB), and the related choice of a real versus nominal Weighted Average Cost of Capital (WACC), as modelling technicalities to be buried deep within spreadsheets.

Yet, the choice of whether to use a nominal or real RAB and WACC can have a significant impact on the profile of tariffs and the regulated company’s ability to finance its investments. In this Insight, we provide an overview of the main options and the impacts of each, to shed light on this seemingly esoteric issue.

High-level options for treatment of inflation

Regulators often set tariffs across multi-year periods. In doing so, they must ensure that the regulated company is compensated for inflation of its costs over that period. There are two common approaches for this:

- Calculate nominal tariffs – express the components of allowed revenue (operating costs, depreciation, return on capital, etc.) in nominal terms to ensure they include inflation. The resulting allowed revenue and tariffs will therefore also include inflation.

- Calculate real tariffs and index them to inflation – express the components of allowed revenue in real terms (ie. excluding inflation) and then add inflation to tariffs, either ex-post based on outturn inflation or ex-ante based on inflation forecasts.

The two might appear equivalent at first glance, but they have different implications for the RAB and WACC, which in turn can have a large impact on the profile of allowed revenues/tariffs.

First, what is the RAB?

The RAB is an important part of many regulatory regimes around the world. It is the regulator’s record of the net value of a company’s fixed assets, from which the depreciation and return on capital components of allowed revenues are calculated.

The RAB usually differs from the accounting net book value of the company, which incorporates revaluations and accelerated depreciation allowed under tax rules. By keeping its own record of assets (the RAB), the regulator can ensure that tariffs only compensate the company for assets it has paid for, and that compensation is spread over the useful life of assets in a manner that is “fair” to consumers.

Which RAB should be paired with which WACC?

Regulators often view inflation of the RAB as a technical detail and fail to appreciate the significant impact that it can have on tariffs, particularly when introducing RAB-based regulation for the first time. The different approaches (if applied correctly) are equivalent in Net Present Value (NPV) terms over the long-term, but a nominal RAB tends to bring forward cashflows and therefore raises tariffs in the short term, as we demonstrate below.

Furthermore, sometimes regulators and utilities get confused about whether to use a real or nominal WACC when multiplying it by the RAB to calculate return on capital, which can lead to the company under or over-recovering inflation.

The two main options [1] for the inflation treatment of the RAB and WACC are:

- Nominal RAB x Nominal WACC (nominal tariffs) – capex is added to the RAB in the “dollars of the day” and the previous year’s RAB balance is rolled forward without any adjustment for inflation. The RAB is multiplied by a WACC that includes inflation. This approach can appear counterintuitive if one mistakenly thinks that inflation is ‘included’ in both the nominal RAB and the nominal WACC. However, a RAB that stays constant in nominal terms effectively loses its underlying value by inflation each year and the nominal WACC compensates for that loss.

- Real RAB x Real WACC (real tariffs) – when real tariffs are indexed to inflation, the RAB is implicitly adjusted by inflation and holds its value over time. The RAB is multiplied by a real WACC because inflation is already compensated for through the tariff indexation.

What are the implications for tariffs?

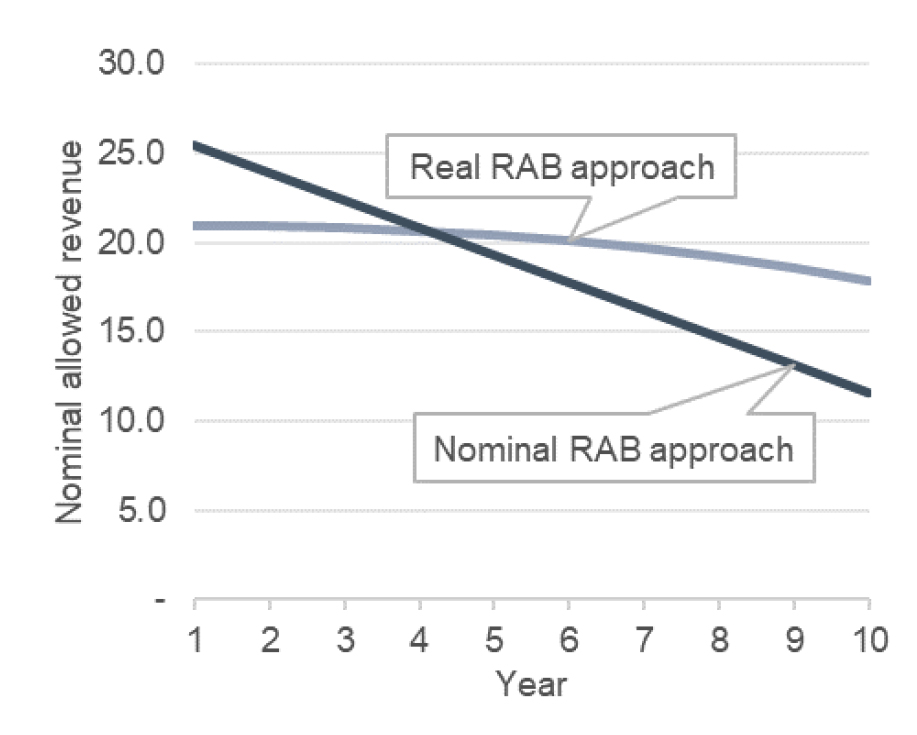

Although equivalent in NPV terms over the life of assets, the two approaches can result in very different profiles of allowed revenues/tariffs:

- The Nominal RAB x Nominal WACC approach brings forward cashflows because the company recovers inflation directly each year through the nominal WACC.

- The Real RAB x Real WACC approach delays recovery by compensating the company for inflation through RAB growth (on which it will earn a return over time).

This impact is illustrated in the figure below, which shows allowed revenue for an asset with a value of 100 and a life of 10 years.

Another way of explaining the difference is that under a Nominal RAB x Nominal WACC approach, assets depreciate faster and therefore asset-related costs are recovered sooner.

Which option is appropriate?

The main advantage of the nominal approach is simplicity and ease of understanding – it mirrors the tax accounting treatment of assets. Also, because it brings cashflows forward, revenues may be better aligned with debt servicing requirements.

The main disadvantage of the nominal approach, and the reason why many regulators favour the real approach, is that a nominal approach may lead to jumps in tariffs as large assets are replaced.

As with so many regulatory issues, specific circumstances and priorities matter. When introducing a new regulatory regime, therefore, regulators should model both approaches and consider which best suits the needs of the sector. More specifically, the regulator should ask whether the priority for the sector is to improve the financeability of investments or to maintain relatively more stable tariffs for customers over time.

[1]A third option is to set nominal tariffs based on an indexed nominal RAB and a nominal WACC. This achieves the same allowed revenues as a real RAB x real WACC approach. Under this option the nominal RAB is indexed to inflation each year, but then the inflation increase is deducted from allowed revenues to prevent double counting inflation.

Richard Bramley

Technical Director

Richard, the author of this Insight has several years’ experience in regulatory policy and analysis in the energy, water and transport sectors. His specific expertise includes regulations, tariff reviews, financing mechanisms, economic and financial analysis, renewables and private sector participation.

To contact Richard directly please email or connect with him on Linkedin below.