ECA INSIGHT >>

A new approach for valuing gas interconnector rents

September 2016

As long term gas contracts for gas interconnector capacity expire, the question of market power of interconnectors becomes more pertinent. The answer to this question largely defines the regulatory treatment of merchant interconnectors. In support of the Dutch, Belgian, and UK energy regulators, ECA developed a novel approach for valuing rent extraction from IUK and BBL to estimate their degree of market dominance. This insight sets out ECA’s methodology and illustrates conclusions that can be drawn from such an analysis.

Regulating interconnectors

As opposed to many TSO-owned interconnectors across Europe, IUK and BBL are merchant interconnectors seeking to make a profit out of the operation and/or sale of capacity rights. IUK and BBL were initially financed by long-term contracts, which are set to expire in 2018 and 2022, respectively. Moving forward, and in line with EU regulation, the capacity of these interconnectors will be available on a variety of long-term and short-term contracts. Regulators may be concerned about the risk of such interconnectors exerting market power.

Standard market power studies focus on market concentration of capacity stocks rather than flows. This can be misleading. Given short-term energy demand is highly inelastic, market power is most likely to be exploited during peak times when supply capacity is constrained. Market concentration measures, such as HHIs, give little indication of whether an energy supplier can exercise market power.¹

Congestion rent seeking

Interconnectors do not offer gas into markets but rather capacity to deliver gas. Those who book capacity are essentially buying an option, the value of which being avoiding exposure to (or exploiting) price spreads between the markets served by the interconnector.

The value of an interconnector’s capacity is thus determined by gas price differences between the interconnected markets. The price differential will determine how much gas shippers are willing to pay for the right to ship gas between the markets. Market power arises through the ability to unilaterally impact this price differential.

For each day of the year, capacity usage on interconnectors could impact the market price. Should for example interconnector capacity be withheld, other more expensive gas supply options may need to be called upon, such as storage.

Restructuring: Choices and Challenges. Puller and Griffen, Eds. University of Chicago Press.

This alters the cost based merit order of gas supply and results in an increase in prices on those days where additional storage would be needed. Exerting market power by interconnectors therefore entails withholding capacity. This could occur either through setting prices for reserve capacity too high or withholding capacity altogether.

Gas shippers may also be able to exert market power by foregoing their option of using their allocated capacity. Given use- it-or-sell-it rules, this would only apply if the shipper were dominant in both the source and target markets.

Quantifying market power: a merit order approach

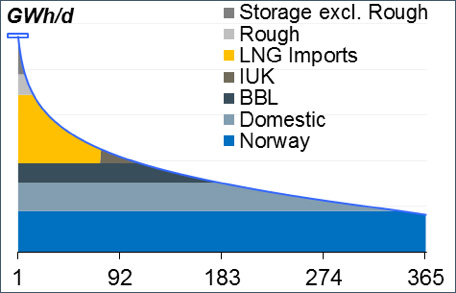

To quantify the degree of market power, we develop a methodology based on gas supply merit orders (Figure 1) in each of the markets linked by the interconnector. The merit orders draw price curves for both markets, which in turn provide price differentials and trade margins.

Figure 1. Stylised UK gas supply merit order

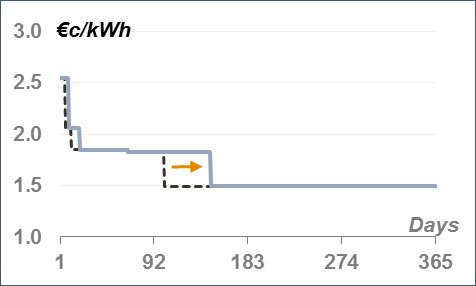

As interconnector capacity is withheld, the merit order changes, which can result in a change of the marginal supply option on some days, thereby shifting price curves (Figure 2).

Figure 2. Withholding capacity: shifting the price curve

The difference in price multiplied by the volume of gas needed to meet demand in the market that is short of supply equals the ‘congestion rents’ an interconnector can reap. The extra congestion rents an interconnector can create may greatly outstrip the foregone revenue from curtailed capacity, particularly when supply is tight and the market price is being set by the costliest supply options.

The developed methodology is a more accurate measure of market power and can help regulators in deciding on the regulatory treatment of interconnectors and determining reserve prices for capacity auctions. For operators and shippers, this approach can inform capacity bidding strategies and asset valuations of interconnectors.

1 See Bushnell, J., 2005, ‘Looking for Trouble: Competition Policy in the U.S. Electricity Industry’, Chapter 6 in Electricity Resturcturing: Choices and Challenges. Puller and Griffen, Eds. University of Chicago Press.